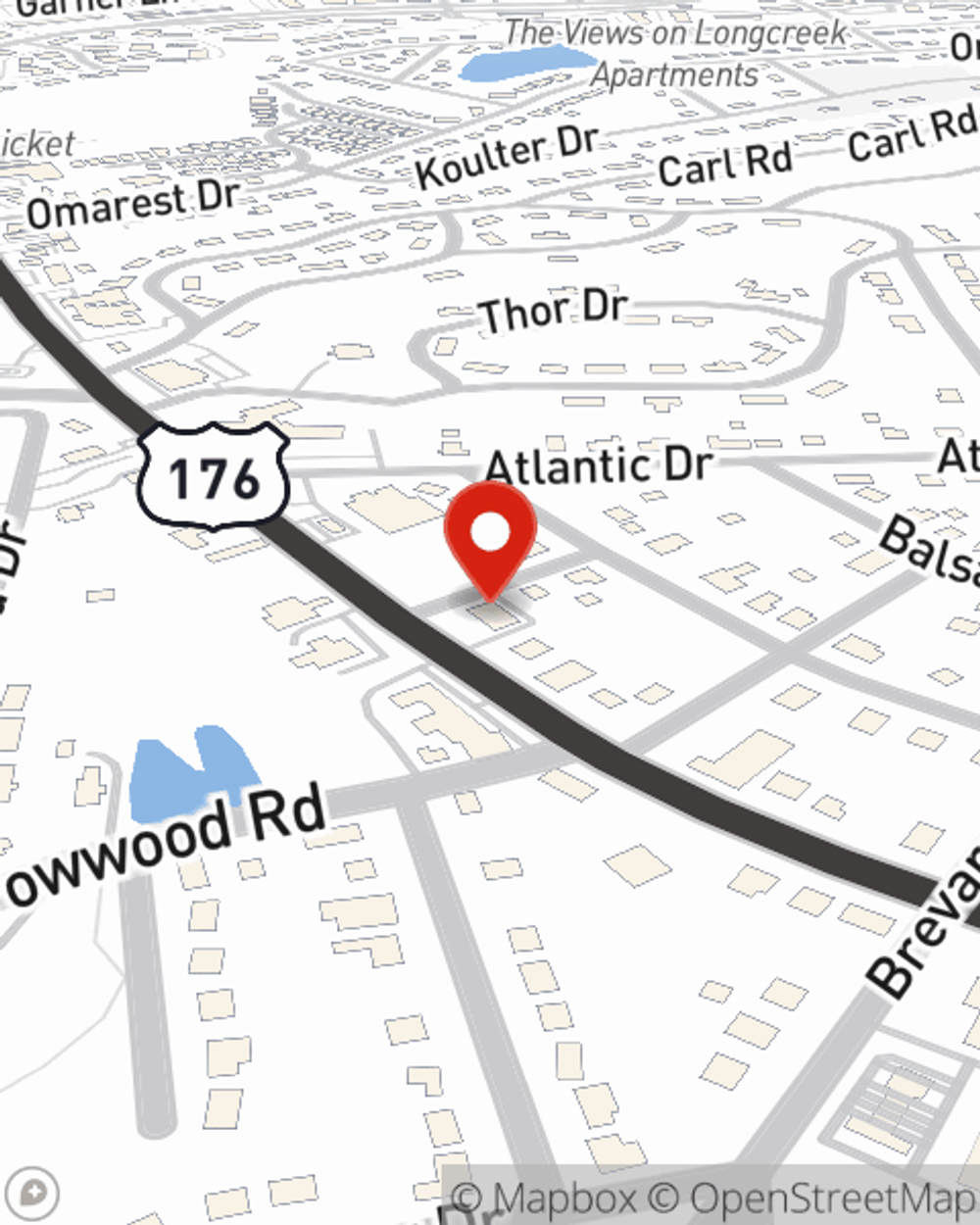

Business Insurance in and around Columbia

Get your Columbia business covered, right here!

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

Running a small business comes with a unique set of highs and lows. You shouldn't have to work through those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, errors and omissions liability and a surety or fidelity bond, among others.

Get your Columbia business covered, right here!

This small business insurance is not risky

Keep Your Business Secure

Whether you own a farm supply store, a beauty salon or a tailoring service, State Farm is here to help. Aside from exceptional service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Ashley Johnson today, and let's get down to business.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Ashley Johnson

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.